Computer depreciation rate

The special depreciation allowance is 100 for qualified property acquired and placed in service after September 27 2017. Alternatively you can depreciate the acquisition cost over a 5-year.

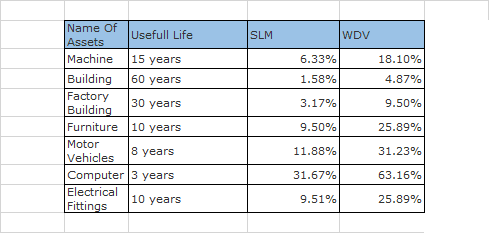

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Computers and computer equipment.

. If a company uses Written Down Value WDV method of depreciation it will need to calculate a new rate for depreciation to depreciate the asset over their remaining useful life. Computer hardware software routers bridges and data acquisition systems are under the sub-head of Electric Equipment. Its refers to the decrease in the value of an asset over time.

What is a sensible depreciation rate for laptops and computers. The depreciation expense for 2019 shall be 1020. Diminishing Value Rate Prime Cost Rate Date of Application.

Computers and computer equipment. The rate of depreciation on computers and computer software is 40. 10003 Tangible Assets 10003 Intangible Assets 10003 Income Tax Rates.

DEP87 2014 sets a depreciation rate for tablet computers and electronic media storage devices including smartphones and MP3 players and similar devices. Applicable from the Assessment year 2004-05. You have purchased a computer for 1000 and estimate you will keep it for 3 years.

All these components attract a depreciation rate of. Yes if you own a computer you should be awareof thedepreciationrate on Computer Accessories and PeripheralsSo if you are using it for business than while. This determination may be.

This could be on a straight-line basis which writes the asset off at 25 of. The opening NBV for 2019 would be 7300 8500 1200. Below we present the more common classes of depreciable properties and their rates.

Mobileportable computers including laptop s tablets 2 years. How to Calculate Depreciation Using the Straight Line Method. 153 rows Computer-to-plate CtP platesetters including thermal and visible.

We also list most of the classes and rates at CCA classes. 170 rows Rate of depreciation shall be 40 if conditions of Rule 52 are satisfied. Hence the depreciation expense for 2018 was 8500-500 15 1200.

About Depreciation Rates in India. Class 1 4 Class 3 5. Diminishing Value Rate Prime Cost Rate Date of Application.

A good and oft-used rate is 25. At the end of the 3 years the. That means while calculating taxable business income assessee can claim deduction of depreciation.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

Depreciation Calculator For Companies Act 2013 Taxaj

Computer Related Equipment Depreciation Calculation Depreciation Guru

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Accountingcoach

How Long Does A Gaming Pc Last Statistics

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

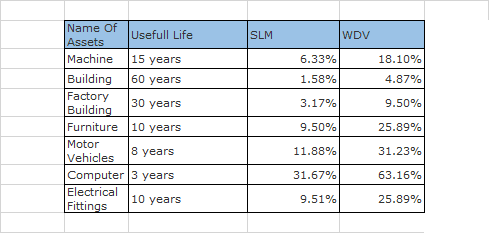

Fixed Assets Showing Depreciation Rate Opening Balance And Addition Templates Powerpoint Slides Ppt Presentation Backgrounds Backgrounds Presentation Themes

Projectmanagement Com What Is Depreciation

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Rates Of Investments Download Table

How To Prepare Depreciation Schedule In Excel Youtube

How Long Does A Gaming Pc Last Statistics

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

An Update On Depreciation Rates For The Canadian Productivity Accounts

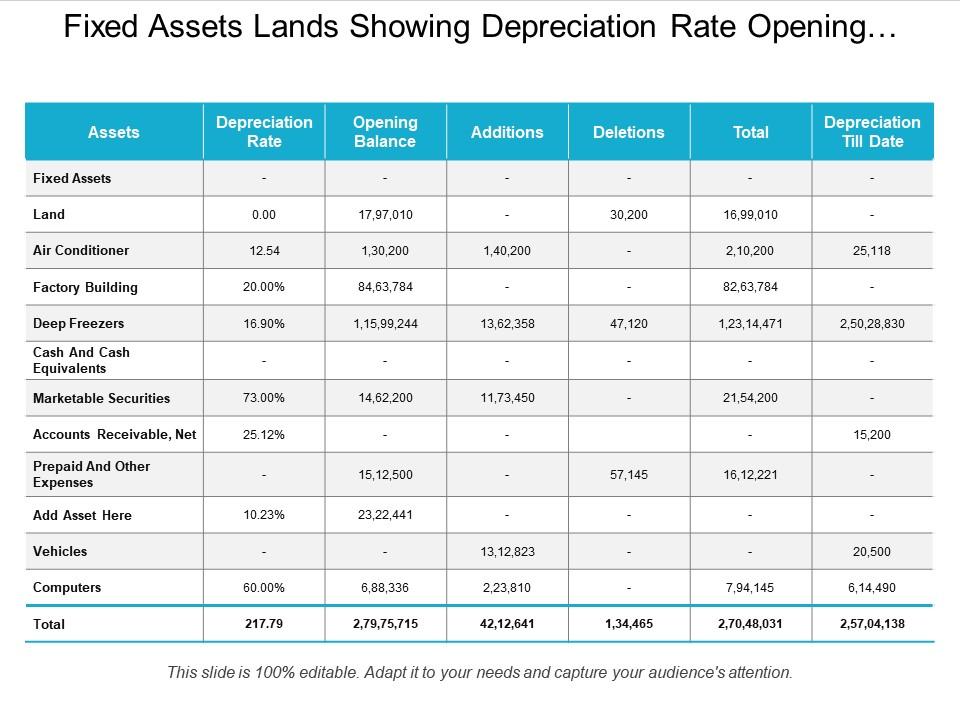

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube